Paying in Pearls

December 12, 2017

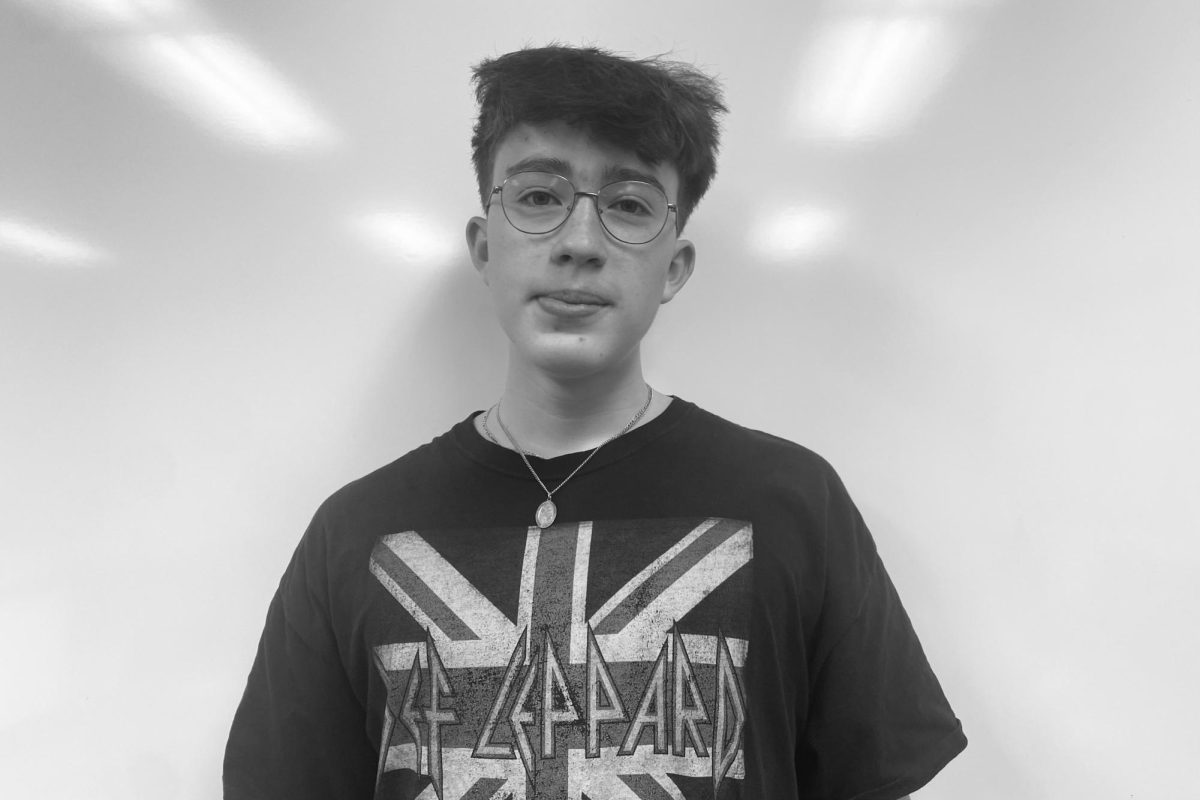

While college tuition is a well-known cost for young people today, another expense that isn’t as widely acknowledged is the fee for simply applying for college. For students who apply to the recommended number of schools, costs of application can add up quickly, ranging in the hundreds of dollars. Lilly Manning ‘18 has a creative solution to the problem of application fees: selling handmade jewelry to raise funds.

“Even if you do have a financially stable home, it’s still so much money on college, not just tuition but finances– I submitted two applications just yesterday and the fees were about $110 for only two, and that’s a grocery trip you could be spending that money on, — Manning said.

“I feel lucky that I’m in a financially stable situation that I didn’t have to worry about [the applications] too much, but I know that there are some people who really struggle with that.”

Manning has only recently begun making and selling jewelry. She sold several pieces at the first-trimester City High art show.

“Over the summer I was staying with my aunt and she had a bunch of jewelry stuff set up and I asked her, ‘Can I play around with this, see what I can make?’” Manning said. “I thought about starting an Etsy but you have to be 18 and I’m 17. I [thought]… here’s a great solution: I can sell it at the art show.’”

However, age restrictions evidently mean less in the real world than online, as Manning’s jewelry sold well. “Out in the open, if your work is good and people have the money to buy it they definitely will be interested,” Manning said, acknowledging, “sometimes they do underestimate you because of your age and that does make it difficult. You have to prove, ‘No, I’m not stupid, I’m not dumb, I know not to blow all my money on one thing. I can sell it and I can guarantee you it will be good.’”

Manning is aware that while this money is helpful for her, there are others who may need more financial aid to attend college–if they are even able to attend at all.

“I know some people who have parents that work two or three jobs and they’re still struggling to pay a mortgage and feed all their kids, and I admire them so much,” Manning said. “I can’t imagine those people paying the full price of college tuition, so I’m glad we do have systems like scholarships or fee waivers.”

But these systems are not all-encompassing, and working through college to come out the other side debt-free is no longer as feasible as it has been in the past.

“Some people have to choose between staying home and taking care of their family or taking a year off to get maybe enough money for half a year of tuition,” Manning said, “and if you are just in the middle you might not get any help at all, so you have a lot of hard decisions to make.”

And the cost of applications, unlike tuition, is no guarantee.

“You may or may not get in, or you might not get as many scholarships as you thought you would, or you may not get the classes you want, so it’s kind of just putting yourself on the line,” Manning said.

Other students are also aware of the issue and are attempting to give themselves or others financial cushioning for applications.

“A lot of people in [my] art class…sold their art at the art show,” Manning said. “Tatum Hills…is taking pictures of people for their senior photos, and some people want to pay her but she’s doing it for free for people who can’t afford it with college applications.”

Manning asserted that there are students who are financially affected by these fees in a dramatic way.

“Especially because a lot of them are between thirty and a hundred dollars, it gets really, really expensive,” Manning said. “I feel like people do have to choose between putting food on the table and getting into college.”

Patricia Barker • Dec 13, 2017 at 12:43 pm

That’s my amazing niece! She is a mighty girl💪🏻